If you're thinking about retiring overseas, it is important to consider the financial implications. You will want to know if there are medical facilities in the area, whether there are specialists in the area, and how long does it take to get a prescription filled. You should also check whether taxes are involved. Consider taking a look over your current insurance policy to see how it would be affected in a foreign country before you make any decisions.

You can get health insurance

It can be difficult to retire in the U.S. if you are not able to access health care in rural locations and have high medical bills. Medicare does NOT cover expatriates living abroad. You have three options: purchase a local policy, invest in international health insurance, and opt out completely. Here are some tips to help make the best decisions regarding medical care when you travel and work abroad.

Planning ahead

It is important to plan ahead for your retirement abroad. Be aware of your financial needs and cultural preferences. Also consider the distance you may need to travel with family and friends. Part-time and full-time options are available. To see if the country's culture and economy appeal to you, go there. The U.S. State Department has an extensive guide to retiring abroad. Decide if you would like to live permanently or part-time in the country. Once you've decided on a destination to visit, do some research about the country's political as well as economic stability.

Costs

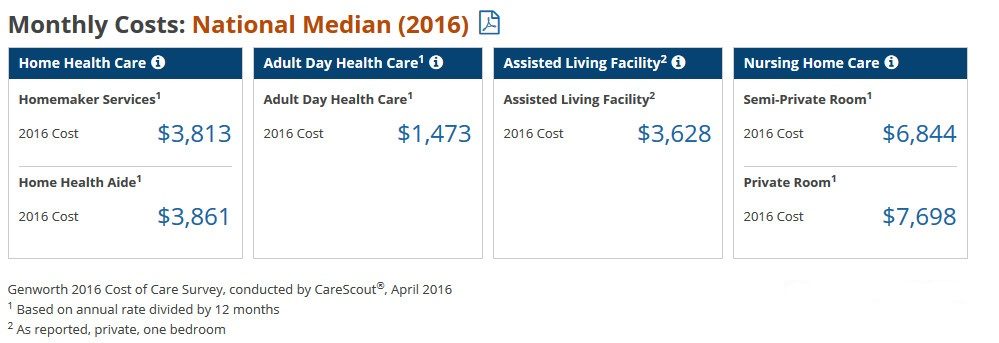

There are certain expenses that you should be aware of if your retirement plans include a move outside the U.S. You will need foreign insurance to cover your health. Medicare doesn't cover anyone who isn't a citizen of the United States. You may be able to get multiple countries covered for a much lower price than a domestic plan depending on your situation. If your country has low healthcare costs you might be able to drop insurance completely.

Taxes

You can choose to retire abroad if you are a US citizen. However, taxes will not be paid on your global income if you're a US citizen. If your global income exceeds certain thresholds, such as $12,000 per individual or $400 in self-employment income (or both), you will need to file a federal income tax returns each year. You must also convert all your foreign income and assets to U.S. dollars.

Retirees' Places

Retiring outside the US may seem like a risky decision, but it doesn't have to be. Many popular retirement destinations don't require language proficiency or a change of lifestyle. You can even have dinner with American expatriates. You will also be able to enjoy a more relaxed lifestyle and less stress. You'll also enjoy a closer relationship with nature and a lower cost of living.